Balancing Growth and Preservation in a Short Career

For college athletes earning from Name, Image, and Likeness (NIL) deals, the financial window is short—usually just 3–5 years. Top athletes can earn $1M+ from endorsements and appearances, but this sudden wealth requires a careful balance between growing your money and protecting it for life after sports. Without a plan, many athletes end up broke after their careers end. Here are five essential strategies to help NIL athletes build—and keep—a lasting legacy.

The High-Stakes Balancing Act

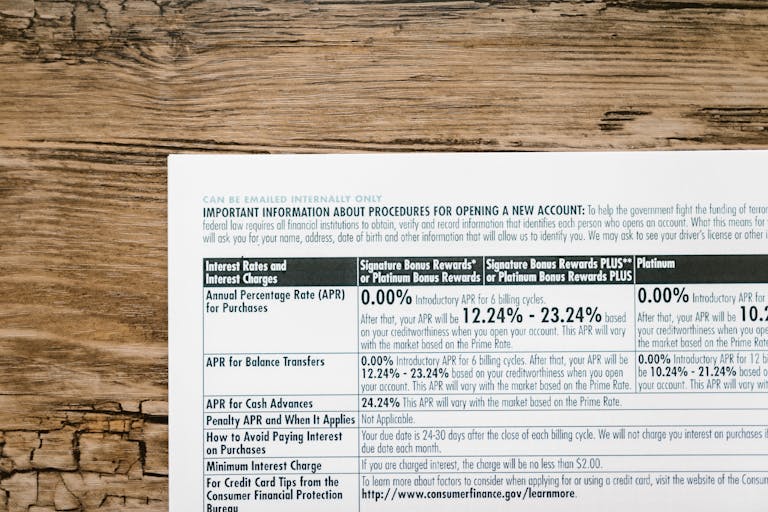

NIL income is unpredictable—lockouts, NCAA changes, injuries, or market swings can cut earnings by 50% from year to year. Taxes (up to 40–50% of income, depending on your state), rapid spending, and big drops in post-career income all add up to major risks. The right plan can double how long your money lasts compared to just chasing high growth.

Case Study: How a $3M NIL Athlete Built Safety and Growth

A 22-year-old athlete with $3M in NIL earnings first went “all in” on high-growth tech stocks and lost 20% in a market dip. Payments were delayed during a lockout, and he was forced to sell stocks at a loss, triggering more taxes. By shifting to a more balanced approach—combining dividend ETFs for steady income, tax-free municipal bonds for preservation, some growth stocks for upside, and a $500K emergency fund—he turned things around. In one year, his portfolio recovered, grew to $3.2M, and generated $30K in passive income every quarter.

Five Strategies for NIL Wealth Growth and Preservation

- Diversify Smartly: Don’t bet it all on high-growth. Split your money among S&P 500 ETFs (growth), dividend funds (steady income), and tax-free municipal bonds (safety), plus a healthy cash reserve.

- Build a Cash Buffer: Set aside 6–12 months of expenses in a high-yield savings account. If a lockout or injury cuts your income, you won’t need to sell investments at the wrong time.

- Max Out Tax Shelters: Use Roth IRAs or SEP-IRAs to shield as much income from taxes as possible. Invest in tax-free assets where you can.

- Earn Extra with Covered Calls: Selling covered calls on your stock holdings can bring in steady extra income (1–3% per month) without touching your main investments.

- Keep Spending in Check: Limit lifestyle spending to 20% of your NIL income. The rest should go to savings and investing for your future self.

Actionable Tips for NIL Athletes

- Track Everything: Use apps like Personal Capital to watch where your money goes, and audit your portfolio monthly to keep your plan on track.

- Automate Saving and Taxes: Set up auto-transfers from every payment into savings, tax, and investment accounts. Don’t wait until tax season to set money aside.

- Build Your Team: Hire a fiduciary advisor and a CPA who know athlete income, NIL rules, and tax law. Never go it alone.

- Stay Flexible: Monitor the sports and NIL landscape—rules and risks change fast. Adjust your buffers and investments if the game changes.

- Reinvest All Passive Income: Compound your returns by reinvesting dividends and other “bonus” income into long-term growth assets.

Common Pitfalls to Avoid

Don’t fall for high-risk “hot tips,” over-spend early, or ignore your taxes. Income volatility, big tax bills, and the temptation to chase the next big investment are why so many NIL fortunes disappear fast. A balanced plan is your best defense.

Conclusion

A short NIL career can still set you up for a lifetime of financial security—with the right mix of growth, safety, and discipline. The athletes who win off the field are the ones who plan, diversify, and keep their spending in check. For a personalized game plan, reach out to a fiduciary advisor or schedule a free Strategy Call at freedomcapitaladvisors.com.