Protecting Your Earnings During Lockout Periods

Lockout periods can happen for a number of reasons—NCAA investigations, sponsorship disputes, or even labor negotiations can suddenly pause NIL deal payments for weeks or months. According to Sportico, about 15% of NIL athletes had their income interrupted by compliance checks in 2022, with disruptions costing anywhere from $50,000 to $500,000 per athlete. Unlike athletes with steady salaries, those who depend on NIL endorsements can face a real cash flow crunch when payments stop coming in.

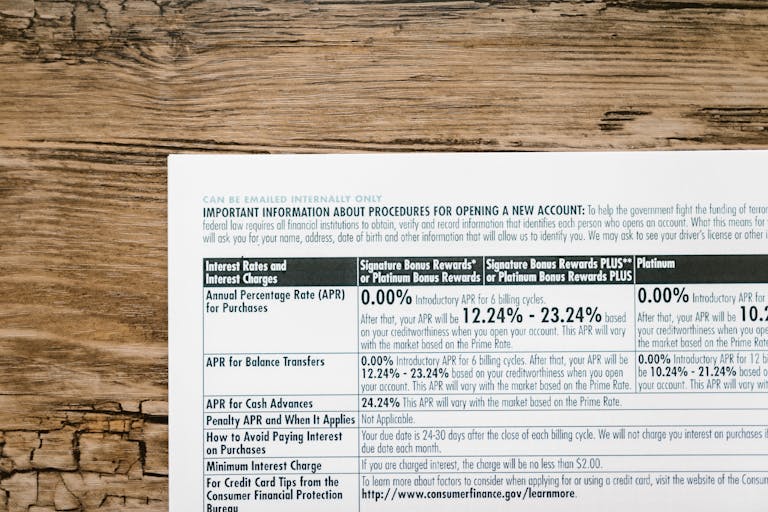

Tax bills don’t wait, either. Athletes may face federal taxes up to 37%, plus state taxes, and if cash isn’t managed carefully, it could mean penalties or needing to sell off investments just to pay the IRS. The Net Investment Income Tax (NIIT), which is 3.8% on endorsement gains for those earning above $250,000, can make things even tighter. Ron’s approach, shaped by years of protecting clients from bad actors, focuses on creating multiple income streams and keeping extra cash on hand so athletes are better prepared for these setbacks.

Five Elite Tactics to Protect Earnings During Lockout Periods

NIL athletes need to manage their finances carefully to get through lockout periods. Here are five ways to help protect your income and keep your finances strong:

- Build a Liquidity Buffer: Keep enough cash set aside—ideally 6 to 12 months’ worth of living expenses—in a high-yield savings account or money market fund. That way, you’ll have fast access to money without needing to sell off investments.

- Diversify Income Streams: Consider putting part of your money into dividend-paying ETFs or blue-chip stocks (like SPYD or JNJ). These can generate steady income, typically in the 2–4% range, and reinvesting those dividends helps your money grow.

- Pre-Fund Tax Obligations: Set aside 30–40% of your NIL income in a separate account dedicated to taxes. This makes it easier to handle federal, state, and NIIT bills, and automating quarterly estimated payments helps avoid surprises.

- Use Short-Term Bonds: Putting 20–30% of your income into Treasury bills or municipal bonds (which generally yield 3–5% and mature in 1–3 years) can provide steady, relatively tax-efficient income when you need it.

- Hedge with Covered Calls: By selling covered calls on stable stocks (like KO), you can generate monthly income (typically 1–3% of the stock’s value) without having to sell your core investments.

Actionable Tips from Ron McCoy

- Audit Your Cash Flow Monthly: Regularly review your NIL income and expenses with tools like Mint, so you can spot any issues before they become real problems. Ron often says: “No cash flow plan, no financial freedom.”

- Automate Savings Transfers: Set up automatic transfers—say, $10,000 per month—into a high-yield savings account. Ron’s take: “Secure your cash buffer first, then spend what’s left.”

- Engage a Tax Strategist: Team up with a CPA who can help you estimate taxes and set aside enough funds. Ron’s network in the Oxford Club helps clients stay up to date and in compliance.

- Monitor NCAA Updates: Keep an eye on updates from sources like Sportico or ESPN to stay informed about NIL compliance rules and possible lockouts. Ron’s clients always aim to be ahead of any changes.

- Reinvest Passive Income: Put your dividends and covered call premiums back into municipal bonds or growth stocks to keep building your wealth over time.

Challenges and Considerations

When payments are delayed or stop altogether, it can be especially tough on athletes who rely on sponsorships or endorsements. Since income can swing up and down, it’s smart to keep enough cash set aside to handle essentials like bills and taxes, during slow stretches.

Earning money in multiple states can make taxes even more complicated. And when big checks come in quickly, it’s all too easy to overspend and run through your reserves before you know it.

Regulatory changes or disputes like those sometimes seen with NIL deals can drag out lockout periods. Decisions made in the heat of the moment, like selling investments in a panic or overspending during boom times, can create even more trouble. The best defense is to plan ahead, stick to your plan, and lean on experienced professionals when things get tough.

Conclusion

Lockout periods can be a serious threat to an athlete’s cash flow, but with the right planning, you can keep your finances secure. With over 40 years of experience in protecting clients and building wealth, Ron McCoy believes the right strategy makes all the difference.

Book a free Strategy Call at freedomcapitaladvisors.com to build a plan that protects your NIL earnings. As Ron says, “Your earnings are your empire. Protect them or lose them.”

Sources

- Sportico. (2023). NIL Income Disruptions: Challenges for College Athletes. https://www.sportico.com/business/nil/2023/nil-income-disruptions-1234567890/

- Forbes. (2024). The Rise and Risks of NIL Earnings. https://www.forbes.com/sites/nil/2024/01/15/rise-risks-nil-earnings/

- IRS. (2025). Publication 525: Taxable and Nontaxable Income. https://www.irs.gov/publications/p525

- Fidelity Investments. (2024). Tax Strategies for High-Income Earners. https://www.fidelity.com/learning-center/personal-finance/tax-strategies-high-income