Athlete Wealth Management

70% of Professional Athletes Are in Financial Trouble within Three Years of Retirement.

Professional and collegiate athletes encounter a unique set of financial challenges including irregular income, short career spans, and the threat of financial exploitation. At Freedom Capital Advisors, Ron McCoy leverages four decades of market and portfolio management expertise to deliver Athlete Wealth Security with comprehensive strategies focused on protecting, growing, and preserving your earnings at every stage of your career and beyond. Our approach emphasizes financial security and proactive education to help safeguard your assets in an industry often targeted by bad actors. We are committed to putting your interests first and treating every client like family.

What Makes you Different?

Unlike traditional investors, Athletes contend with:

- Irregular Cash Flows: Game checks, performance bonuses, and endorsement deals can arrive in lumps requiring careful liquidity planning to bridge off‑season months.

- Career Longevity Risk: The average professional sports career lasts under a decade. Planning must account for early transitions and post‑career income needs.

- Heightened Tax Complexity: Earnings may be taxed across multiple states, and NIL revenues introduce new tax reporting requirements.

- Concentrated Risk: Large payouts or equity stakes in teams/leagues can create undue concentration unless properly hedged and diversified.

- Public Scrutiny & Reputation: Financial missteps can damage both net worth and brand value, making discretion and trust paramount.

Freedom Capital Advisor’s Athlete Wealth Management framework addresses these challenges head‑on, allowing us to educate and protect our clients. We believe education is an important step towards financial freedom. It is critical that we gameplan together, much like having the entire team on the same page.

Meet Playmaker Financial

Playmaker Financial is the athlete-focused arm of what we do, built to educate and protect Young Athletes. Where Freedom Capital Advisors handles the traditional wealth management side, Playmaker speaks your language and lives in your world, focusing on the unique challenges and opportunities that come with NIL deals, contracts, and life in the spotlight.

Through Playmaker, we help athletes understand their money, not just hand it off. We teach about finances and investing in ways relatable to sports, so you can avoid being another statistic. Our goal is to protect your name, your income, and your long-term options, not just your next season.

Playmaker blends real market experience with a younger, tech-savvy approach, giving you a team that understands both the locker room and the long game. Whether you are just starting to earn or already established, Playmaker Financial is built to help you turn opportunity into a lasting legacy. Check out our website to learn more:

Why Choose Us?

Because we actually understand your world. We have worked with athletes before and are currently working with athletes now, so we know the pressure, the short earning window, the noise from “advisors,” family, and social media, and how fast things can change with one injury or contract.

We do not just plug you into a generic wealth plan. We build a gameplan around how athletes earn, spend, and live. That means planning for uneven income, new deals, travel, and the day the checks slow down. We keep the conversations real and relatable, while using our edge in the finance world to design strategies that fit an athlete’s life, not a corporate brochure.

Our role is part coach, part translator, and part risk manager. We help you understand what you own, why you own it, and how each decision affects your long-term freedom and legacy.

Freedom Capital Advisors’ approach is disciplined:

- Statistical & Fundamental Analysis: Ron applies in-depth data analysis to identify trends, evaluate probabilities, and make informed investment decisions based on your needs & risk profile.

- Transparency: Ron ensures clients always know exactly what they’re paying, with straightforward fees and no hidden charges.

- Proactive Oversight: Ron continuously monitors client portfolios and market conditions, making timely adjustments to protect and grow investments.

Our Top 3 Tips for Athletes

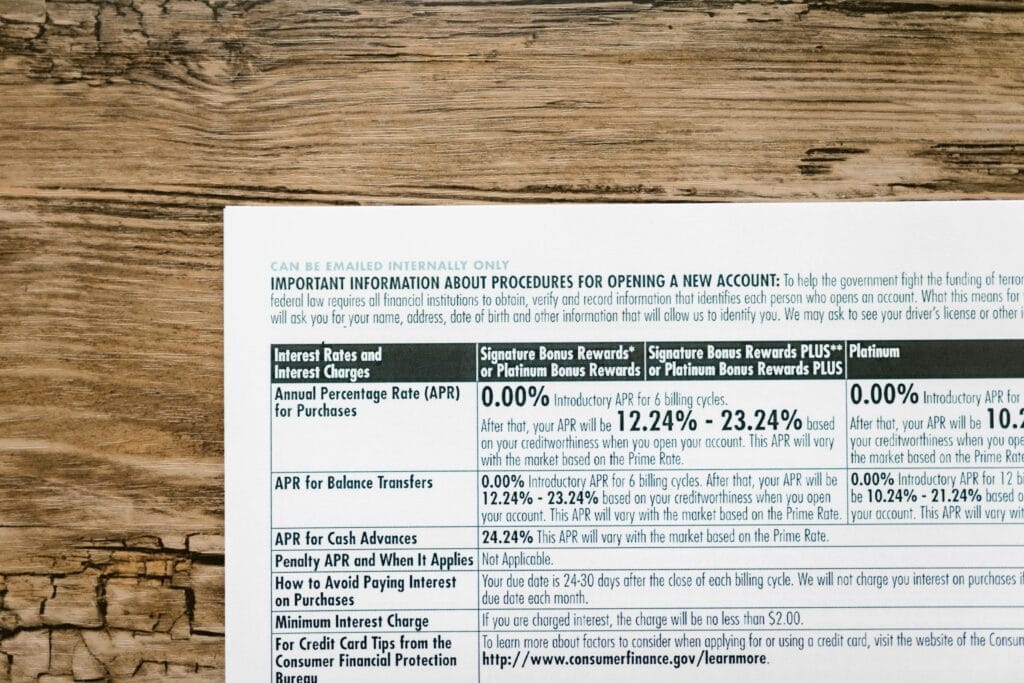

- Be Diligent When Hiring Professionals:

Exercise care when selecting individuals to manage your finances. Prioritize working with those who demonstrate integrity and a proven track record of trustworthiness with a familiarity of working with those in your situation. - Take the Time to Make the Right Decision:

Rushing important financial choices including contracts can lead to costly mistakes, so it’s essential to weigh your options carefully and seek guidance when needed. - Live Below Your Means:

Spending everything you make on lifestyle, cars, or things that lose value is a recipe for disaster. We encourage you to keep a meaningful portion of your money invested in assets that can grow and generate income, while keeping your living expenses at a level that gives you margin and flexibility.

It’s Your empire. now protect it.

Your wealth isn’t just a number, it’s your legacy. But without strategy, it’s a target for taxes, fees, and crooks. We’re here to help you by designing a plan that puts your interests first.

“Wealth without strategy is just a target for thieves.”

Book Your Strategy Session with Ron McCoy

You are also welcome to reach out. I may be on the phone, but you can always leave your name & number and I will get back to you. Text messages are welcomed as well.

Ron Speaks to Athletes …

No Sales Scripts or Elevator Pitches. Just Straight Talk.

Ron’s Playbook is designed to provide you with valuable insights and practical tips. Sign up now to receive your free copy and embark on a journey of knowledge and discovery.

Don’t miss out on this opportunity to enhance your skills and stay ahead of the curve. Simply enter your email below and start reading today!