Navigating Sponsorship Contract Windfalls

As athletes secure larger and more frequent sponsorship deals, effectively managing these windfalls is crucial. Big upfront payments and ongoing endorsement income create remarkable opportunities—but without a disciplined approach, these financial gains can easily be squandered. Strategic planning helps turn short-term wins into lifelong financial security.

The Unique Financial Challenges of Sponsorship Windfalls

NIL sponsorships and endorsement contracts often deliver significant cash up front, which is exciting—but also risky. Without clear planning, athletes may face:

- Overspending after sudden income increases

- Unexpectedly high tax bills and penalties

- Poor allocation of resources, risking long-term security

Real-World Example: The Importance of Proper Management

Former NFL player Clinton Portis earned millions in endorsements but ultimately filed for bankruptcy due to mismanagement and failed investments. His story is a reminder that disciplined planning is essential for anyone receiving a financial windfall.

Source: Bleacher Report – Clinton Portis Bankruptcy

Essential Strategies for Managing Sponsorship Income

- Establish a Financial Plan: Before spending or investing, map out immediate obligations (like taxes) and longer-term goals (like saving, investing, or helping family). A clear plan helps prevent costly mistakes and emotional spending.

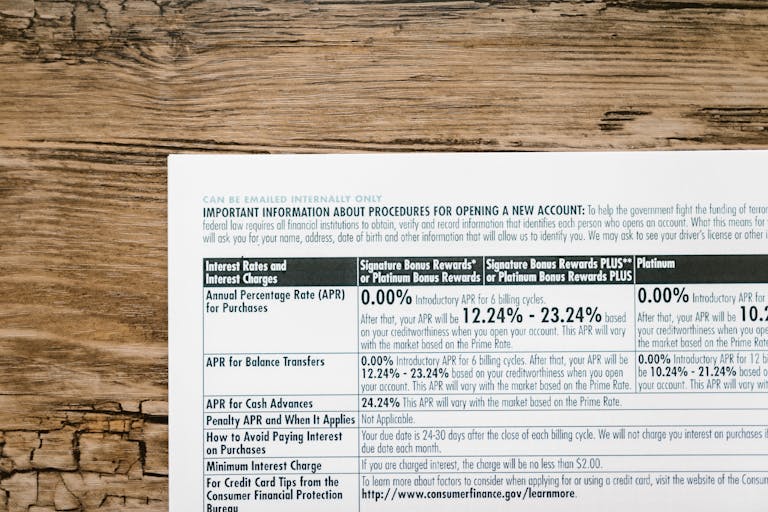

- Tax Planning and Optimization: Large endorsement checks can trigger high taxes, especially if paid all at once. Work with a CPA and financial advisor to forecast your tax liability, set aside funds, and consider ways to optimize taxes through timing and account selection.

- Diversify Investments: Don’t put all your winnings into a single asset or speculative opportunity. Build a balanced portfolio that includes stocks, bonds, and cash for both growth and safety.

Case Study: Turning an NIL Windfall into a Foundation

A young collegiate athlete received large upfront NIL payments. By prioritizing tax planning, building a simple budget, and investing in a diversified portfolio with the help of a fiduciary advisor, she avoided the classic pitfalls—setting up emergency savings, covering taxes, and establishing a foundation for her future goals.

Actionable Advice for Athletes Receiving Windfalls

- Set Aside Taxes First: Immediately reserve enough cash to cover all federal, state, and local tax obligations from every deal. Don’t let a tax bill catch you off guard.

- Build an Emergency Fund: Save a portion of your windfall for unexpected expenses, injuries, or income gaps—at least 3–6 months of living costs.

- Seek Professional Guidance: Choose experienced financial advisors and CPAs who understand athlete compensation, NIL rules, and tax law. Insist on clear, transparent advice—never sign contracts or make big investments alone.

Summary

Sponsorship windfalls and NIL deals can be a launching pad for lifelong financial security—but only with proactive planning, tax discipline, and smart investing. By treating every endorsement as both an opportunity and a responsibility, athletes can avoid the pitfalls of overspending and build wealth that lasts well beyond their playing careers.