Why We Built Yield Forge: Turning Ron’s Covered Call Logic Into a Real-Time Analysis Engine

My father and I used to work through covered call scenarios together, manually. Bear case. Flat case. Bull case. We’d talk through the numbers, think it through, make a decision. It worked. But it was manual and slow. And when you’re trying to evaluate an entire options chain across multiple strikes and expirations, slow means you’re leaving the best opportunities unexamined.

That’s when I decided to build what we call Yield Forge.

The Problem We Were Solving

Ron McCoy has been managing money for more than 40 years. Before I joined Freedom Capital Advisors, he was already applying the right kind of thinking to covered calls, not just generating premium, but stress-testing every position across outcomes. What happens if this stock drops? What if it stalls? What if the market runs higher and we get called away?

That kind of scenario discipline is the backbone of a real income strategy. The problem was doing it manually, one strike at a time, took serious time. And time limits how many positions you can properly evaluate before you have to make a call. We needed a way to see everything at once.

What Yield Forge Actually Does

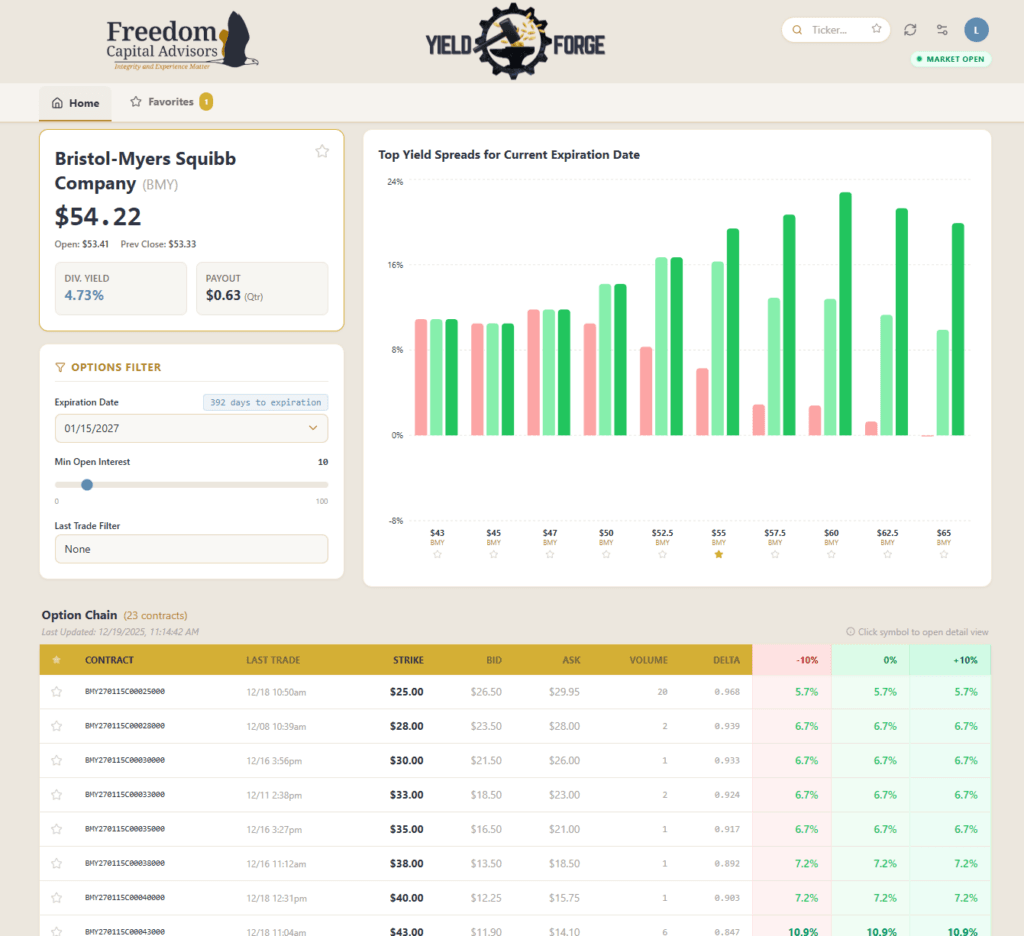

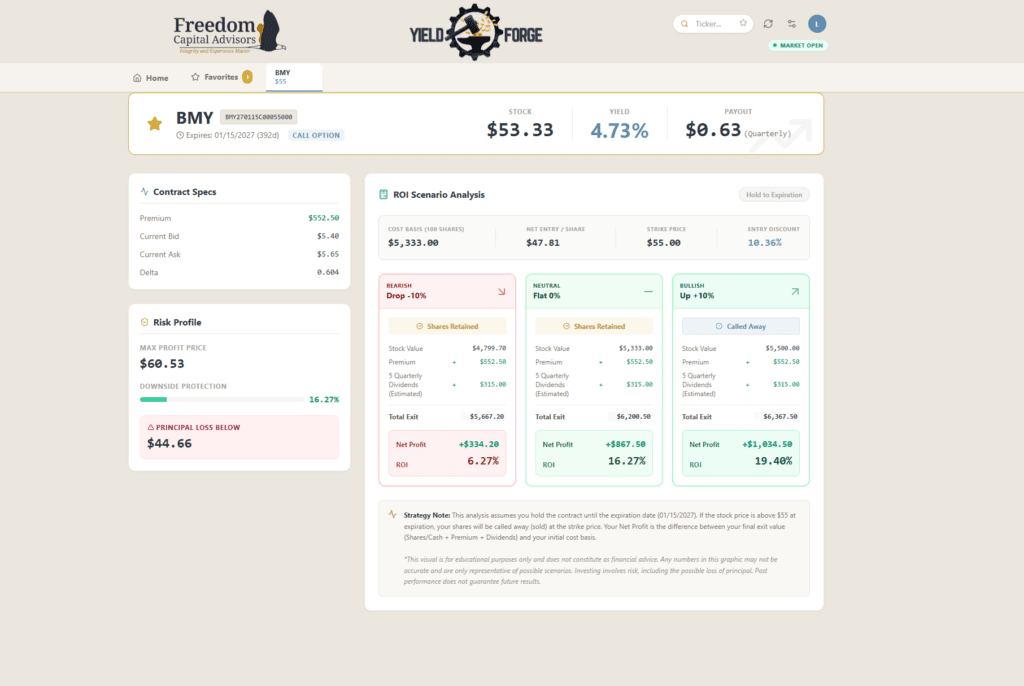

Yield Forge is a scenario-based ROI analysis engine for covered calls and buy-writes. Before we enter any position, it maps out the full picture across three stock price scenarios at the time of expiration. We’re able to adjust the variation for the scenario. For example, with 10% movement in either direction:

- Bear (-10%): The stock drops 10% from its current price.

- Flat (0%): The stock remains flat.

- Bull (+10%): The stock moves higher, capped at the strike price.

For every scenario, we see the full return including dividends captured and we also see other metrics like the exact “Principal Loss Below” breakeven and Max Profit Price. And we see it in real time across the entire options chain, not just one strike we’ve already decided on.

This is not a black box. There is no algorithm producing a “buy” signal. It’s a decision-support tool. The math is visible. The scenarios are explicit. We use it to choose strikes based on our actual market conviction, not intuition alone.

The Difference Between One Call and the Full Chain

Before Yield Forge, our process looked like this: find a stock we liked, pick a strike that seemed reasonable, run the numbers on that one position. That approach works. But it doesn’t tell you whether that strike is the best one for the situation.

Now, we pull up the full options chain and immediately see the complete picture. If we have higher conviction on a position, we can look further out of the money and see exactly what that does to our return across all three scenarios. If we want a more defensive posture, we go in the money and see precisely how much downside protection we’re buying and what we’re giving up on the upside.

That analysis is not something you can do quickly by eyeballing a chain. And in our business, being able to evaluate more opportunities with greater precision means better outcomes for clients. That’s the entire point.

How It Evolved

Yield Forge is now on its third iteration. The first version was simple: a basic algorithm that ran the three scenarios and returned the numbers. Ron and I built the logic together, taking the mental framework he’d been applying for years and translating it into code. That first version validated the concept. The math was right. The workflow made sense.

Each iteration built on that foundation. The current version scans a universe of 240-plus dividend-paying value stocks: quality, established names across sectors. Our scanner surfaces the top opportunities ranked not just by raw yield, but by consistency of returns across all three scenarios. That distinction matters. A high yield that collapses in a down market is not actually a good trade. We want positions that hold up regardless of what the market does.

Why This Makes FCA Different

Most advisors do not build their own tools. They use what’s available off the shelf, which is fine, but it means their analysis is constrained by what those tools show them. Yield Forge was built specifically for our strategy, our stock universe, and our clients’ income goals. The logic it applies reflects decades of Ron’s thinking about covered calls, systematized into something that runs in seconds.

When we sit down with a client, we are not asking them to trust us because we have a track record (though we do). We are showing them the analysis directly. Here is the position. Here is what happens if the market drops. Here is the breakeven. Here is the return if the position stalls. That kind of transparency is not something you get at a large brokerage where the portfolio is a black box and the advisor cannot explain why any given holding exists.

We are active managers. We earn our role by evaluating every position with intention. Yield Forge is what makes that possible at scale.

Built for Income. Designed for Discipline.

The positions we typically analyze involve quality, dividend-paying value stocks. We look for names that are relatively stable and predictable, then sell covered calls against them to generate additional premium income. The dividend yield combined with the option premium creates a blended income stream that, depending on the setup and market conditions, can produce meaningful returns with a clear downside picture built in.

None of that is possible without understanding what you are stepping into before you enter the trade. That is what Yield Forge was built to provide. Not after the fact. Before you pull the trigger.

If you want to see what that looks like applied to an actual portfolio, we are happy to walk through a live scenario analysis. That is where the tool becomes real.

Want to see Yield Forge in action? We run scenario analysis on real positions during our strategy sessions. Schedule a free strategy session to see how we evaluate income opportunities for clients, or explore our Precision Investment Planning approach.

Yield Forge is a proprietary internal analysis tool developed by Freedom Capital Advisors for use by its advisors. It is not available to the public and does not constitute investment advice. Scenario analyses are hypothetical and illustrative only, they are based on assumed price movements and do not guarantee future results. All investment strategies involve risk, including the possible loss of principal.